Payroll Services is responsible for processing payroll and required deductions including taxes and retirement withholdings. We strive to provide our employees with excellent customer service to meet their payroll needs.

Appointments are strongly encouraged in order to abide by the health and safety guidelines found at our COVID-19 website.

COVID-19: Employee Information & FAQs

COVID-19: Palomar College Campus Updates

Payroll Services is responsible for processing payroll and required deductions including taxes and retirement withholdings. We strive to provide our employees with excellent customer service to meet their payroll needs.

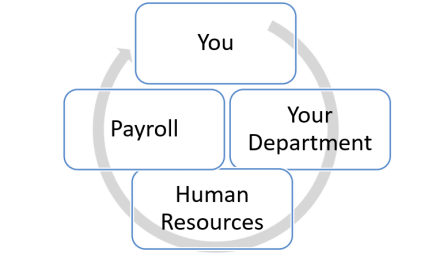

Payroll Process

The payroll process requires collaboration between employees, employees’ departments, Human Resources and Payroll. We work as a team to make sure employees are paid accurately and on time.

HOW AM I PAID?

- Employees are paid on a monthly basis.

- Payday is dependent upon your employment category.

- If payday falls on a weekend or a holiday, payday is the last working day prior to that date.

- Select direct deposit to bank account or receive paycheck via Campus or USPS mail.

See your employment category below for details.

Payroll Information by Employment Category

Payroll Forms

Employees are required to submit necessary payroll forms by a specific due date. See your employment category above for details.

The payroll forms are also available to download here. Please do not attach any of these forms to an email since original signatures are required for processing.

Payroll New Employee Orientation

New Employee Orientation

For more detailed information, click Payroll Presentation for PD Training.